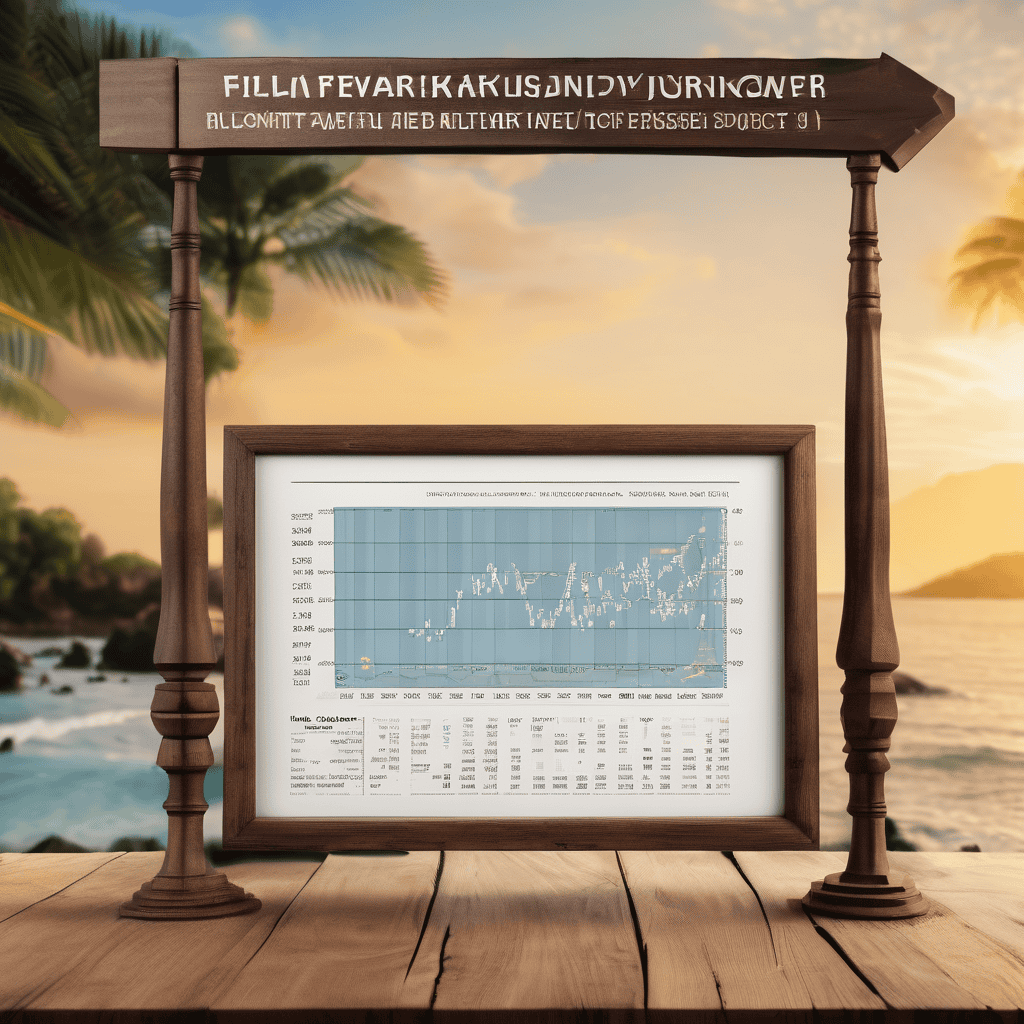

Trading activities on the South Pacific Stock Exchange (SPX) surged to $62.65 million in 2025, marking the highest annual trading value since 2015. According to a statement from SPX, this reflects a remarkable 68 percent increase compared to the previous year, signaling a significant uplift in trading activity and investor engagement across the market.

The daily average turnover, a key metric for stock exchanges to evaluate market dynamics, registered a 69 percent rise in 2025, reaching $249,610. This improvement showcases the increasing momentum in Fiji’s capital markets.

Corporate performance was exceptionally strong in 2025, with listed companies distributing a record-breaking total of $103 million in dividends to shareholders, soaring above the previous year’s high of $76 million. Dividends were distributed by 18 of the 20 companies listed on the exchange, continuing the trend of consistent returns seen among SPX participants. The financial success of these companies was evident, as 19 out of the 20 firms reported profits last year.

Another landmark development occurred in 2025, as both equity and debt offerings for listing were registered for the first time in Fiji’s capital market history within a single calendar year. This included an equity initial public offering by Shreedhar Motors Limited and a corporate bond offering by RB Patel Group Limited, demonstrating a renewed interest among private sector enterprises in utilizing the stock exchange for long-term growth and financing strategies.

Nitin Gandhi, chairperson of SPX, remarked that the performance in 2025 reflects growing confidence in Fiji’s capital market. He noted that the increase in trading value and transaction activity points to a market that is becoming increasingly active and reliable for investors. Gandhi highlighted the importance of this activity in fostering price discovery, liquidity, and overall market credibility.

The robust dividend outcomes and favorable market returns underscore the strength of listed companies in Fiji. The simultaneous registration of equity and debt capital raising offers throughout the year signals a revitalized interest from the private sector in accessing public markets to drive business growth and diversification. Collectively, these developments indicate that the groundwork for a more robust and resilient capital market in Fiji is being firmly established.

Leave a comment